Why a Secured Credit Card Singapore Is Vital for Building Your Credit History

Why a Secured Credit Card Singapore Is Vital for Building Your Credit History

Blog Article

Revealing the Possibility: Can People Released From Insolvency Acquire Credit Rating Cards?

Understanding the Influence of Personal Bankruptcy

Upon declare personal bankruptcy, people are faced with the significant consequences that penetrate numerous facets of their financial lives. Personal bankruptcy can have a profound effect on one's credit report score, making it testing to accessibility credit score or car loans in the future. This economic discolor can remain on credit scores records for a number of years, impacting the individual's capability to secure desirable rate of interest or economic possibilities. Additionally, insolvency may cause the loss of possessions, as particular ownerships might require to be liquidated to pay back financial institutions. The psychological toll of bankruptcy ought to not be taken too lightly, as people may experience feelings of stress, shame, and sense of guilt as a result of their financial circumstance.

In addition, bankruptcy can limit job opportunity, as some companies carry out debt checks as part of the working with process. This can present a barrier to people looking for new task leads or occupation advancements. Overall, the influence of insolvency extends past monetary constraints, affecting different facets of a person's life.

Elements Influencing Credit History Card Authorization

Getting a charge card post-bankruptcy is contingent upon various essential variables that substantially affect the authorization process. One crucial variable is the applicant's credit history. Complying with bankruptcy, people usually have a reduced credit report because of the adverse influence of the bankruptcy filing. Charge card business typically look for a credit history that shows the candidate's capability to handle credit score sensibly. Another crucial consideration is the applicant's revenue. A steady income reassures credit scores card companies of the person's capability to make prompt payments. Additionally, the size of time considering that the bankruptcy discharge plays an essential function. The longer the period post-discharge, the much more desirable the opportunities of authorization, as it shows monetary security and accountable credit score actions post-bankruptcy. Moreover, the sort of charge card being made an application for and the provider's specific requirements can likewise affect approval. By thoroughly taking into consideration these aspects and taking actions to reconstruct credit rating post-bankruptcy, individuals can enhance their leads of acquiring a bank card and functioning towards financial recuperation.

Steps to Restore Credit Rating After Bankruptcy

Restoring debt after personal bankruptcy needs a tactical strategy concentrated on economic technique and consistent debt administration. The very first step is to assess your credit history record to guarantee all debts included in the bankruptcy are precisely mirrored. It is necessary to establish a budget plan that prioritizes financial obligation payment and living within your ways. One efficient technique is to get a guaranteed bank card, where you transfer a specific quantity as collateral to develop a credit line. Prompt repayments on this card can demonstrate accountable credit usage to possible lenders. Furthermore, consider ending up being an authorized user on a relative's bank card or checking out credit-builder financings to more enhance your credit rating score. It is vital to make all settlements in a timely manner, as payment background significantly influences your credit history. Patience and willpower are key as rebuilding credit takes some time, however with devotion to sound financial methods, it is feasible to boost your creditworthiness post-bankruptcy.

Guaranteed Vs. Unsecured Credit Rating Cards

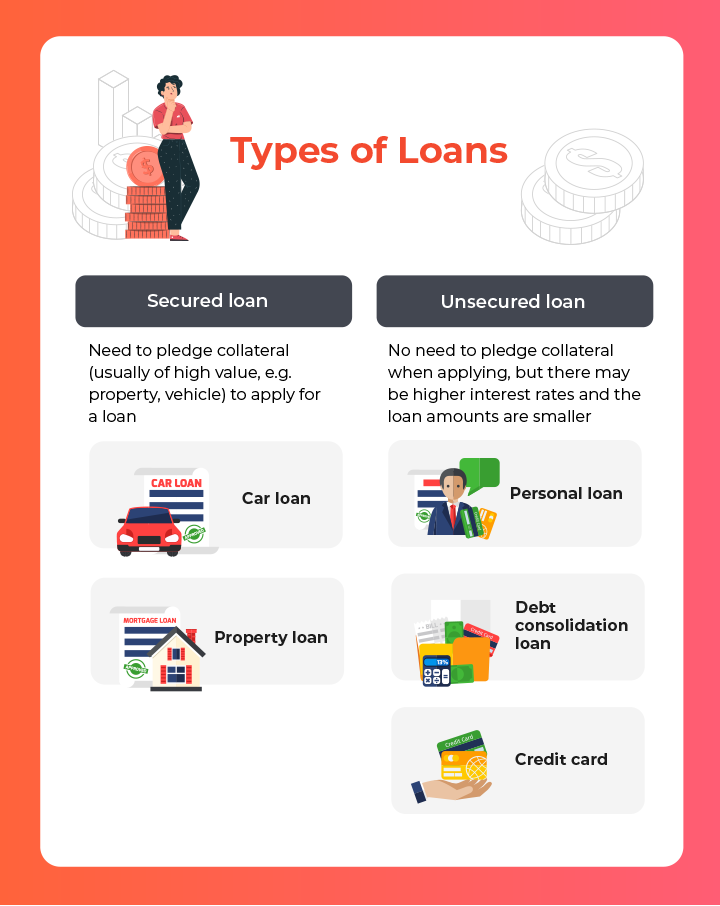

Adhering to bankruptcy, people often think about the selection between secured and unsecured credit score cards as they intend to reconstruct their credit reliability and financial security. Protected credit score cards require a cash money deposit that offers as security, normally equivalent to the credit rating limitation provided. Eventually, the choice between safeguarded and unprotected credit score cards must align with the individual's financial goals and capacity to manage credit rating properly.

Resources for Individuals Seeking Credit Rebuilding

One beneficial source for individuals looking for credit rebuilding is credit history counseling agencies. By functioning with a credit report therapist, people can get insights into their credit scores reports, learn techniques to boost their debt ratings, and receive guidance on managing their finances efficiently.

Another practical source is credit history surveillance services. Check This Out These services allow people to keep a close eye on their credit rating reports, track visite site any errors or changes, and find possible indicators of identification burglary. By monitoring their credit rating routinely, people can proactively deal with any type of problems that may develop and ensure that their credit score details depends on date and accurate.

Moreover, online devices and resources such as credit history simulators, budgeting apps, and monetary proficiency internet sites can offer individuals with important details and devices to help them in their credit score rebuilding trip. secured credit card singapore. By leveraging these sources successfully, individuals discharged from personal bankruptcy can take significant actions towards boosting their credit rating health and safeguarding a much better financial future

Final Thought

Finally, individuals released from bankruptcy may have the opportunity to get credit history cards by taking actions to reconstruct their credit history. Variables such as credit history history, debt-to-income, and revenue proportion play a significant duty in credit history card approval. By recognizing the impact of bankruptcy, selecting between safeguarded and unprotected bank card, and using resources for credit score restoring, individuals can boost their credit reliability and possibly obtain access to debt cards.

By working with a debt therapist, people can obtain understandings right into their credit rating records, learn strategies to improve their credit rating scores, and get assistance on handling their finances successfully. - secured credit card singapore

Report this page